A letter from the President:

Home Sweet Home

A good friend of mine builds homes here in BC. He makes money doing it, but he takes a lot of risk and he’s always stressed. He is currently building a tower in Vancouver. He bought the site almost 5 years ago, applied for permits, and waited. Costs rose and interest rates went up, but the project looks doable so he is eager to start building. To build a tower, you need to dig a hole, a very big hole, which costs a lot of money, usually provided by a construction loan funded by your bank. But banks require a certain number of home presales before they will make the loan. More delays.

So, my friend has an idea: Rather than wait until the bank’s presale target is met (they start selling in September), he asked the city to allow him to delay his multi-million dollar “community benefit” cheque to the city for nine months and use that money to dig the hole, to start building the homes now. The city gets new homes, and he pays a bigger community benefit cheque, including significant interest, a few months later. It’s a no-brainer, a win-win, and so the city agreed.

Well, the press got a hold of this and of course, they spun it as a big developer getting a break using city dollars! My friend now has a public relations nightmare.

Big Bad Developer

We live in a world where the people who build homes are considered evil and yet, if you look at any survey, the biggest issue society faces today is a lack of housing. Wouldn’t you think that those who are helping solve the problem would at least be tolerated?

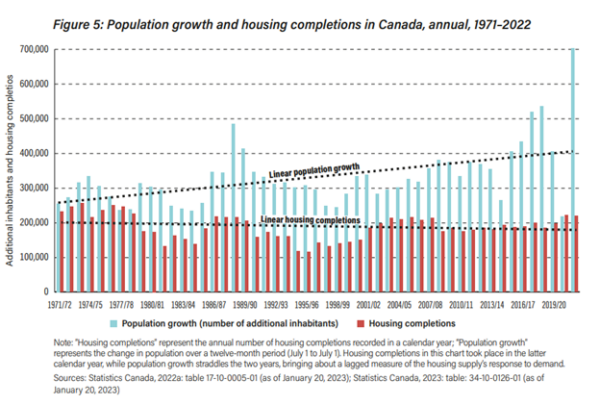

Developers build homes; it’s what they do. I don’t feel sorry for developers – they generally do pretty well – but let’s be clear, we need them if we want to house the record 1 million new residents Canada added in 20221, as well as the 500,000 new immigrants the federal government want to welcome over the next 3 years.2 Canada is now 40 million people with about 5 million of them in BC. According to the press, many, if not most, immigrants want to settle in the big cities, especially Toronto and Vancouver, where they will find communities with their own culture and language. Yet it is these same cites that, I think we can agree, are way short of homes. Look at the mismatch between population growth and housing completions published by the Fraser Institute3:

The simple rule of supply and demand from economics 101 states that a shortage of anything drives up prices. The price of homes in Vancouver and Toronto is through the roof.

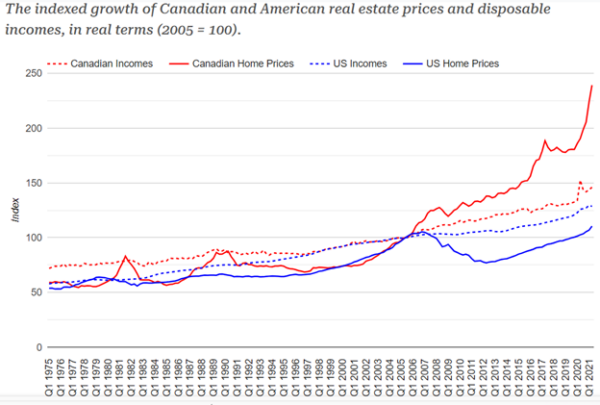

See note 4

Building is Hard

Make no mistake, building housing is challenging. It takes skill, patience (permits can take years), hard work, and some risk. Costs go up with inflation, interest rates rise, permits take time, and the building code keeps getting more complicated. New homes need sprinklers, heat exchangers, and must be energy efficient with double and triple glazed windows and a high R-level (good insulation). Canada’s residential price index has risen 51 percent since the first quarter of 2020, outpacing the 13 percent gain for the consumer price index5. There is also the very significant issue of land, which is highly priced and, at least in Vancouver, in very short supply.

Buy or Sell Real Estate

You don’t have to look too far to find wealthy people in Vancouver that have made money in real estate. Some of the wealthiest families from the Aquilini family to the Gaglardi and the Beedie families made their fortunes in real estate. But consider this: Mortgage rates dropped over the generation from 1981, when Paul Volcker was the Fed Chairman and the US Federal funds rate was 20%, to today, or at least until 2020, when 5-year mortgage rate bottomed under 2%. Generally lower rates have meant lower “cap rates”. The capitalization rate, or cap rate, is used in the world of commercial real estate to indicate the rate of return that is expected to be generated on a real estate investment property. The math is simple: lower rates mean high real estate values and so for a generation, real estate investors have generally done very well. That era, at least for now, maybe over. Cap rates have climbed, and prices have dropped or at least flattened. I am not saying prices will go down and some markets remain very strong, but the rate-driven inflation in property values appears to have stopped.

One of the features of real estate is it is not liquid. If you participate in an investment in a property and you want out, you may have to wait until new investors are prepared to take your place. While many real estate funds continue to perform well in this market, especially those focused on residential and industrial, new money is taking a bit of a pause.

We continue to believe quite strongly that portfolios should have weight to real estate, but this real estate “pause” does support our management principles that portfolios should always be appropriately diversified with weights to equities for growth, bonds for downside protection, and alternatives and real estate to reduce volatility.

Mid-Year Financial Update

Here’s how the markets look for 6 months to June 30, 2023 (in Canadian dollars):

- S&P TSX (The Canadian index) +4.0%

- Dow Jones (30 prominent US companies) +3.8%

- S&P500 (500 largest US public companies) +15.9%

- Oil (West Texas Intermediate price) -12.1%

- Gold (per oz) +5.0%

The Canadian market is positive, as is the Dow, gold is steady, and oil has lost some of its energy, but the bigger gains can be seen in the S&P500, the main index of large US public companies. In fact, the S&P500 is now 20% above its 2022 low it reached of 3,577 on October 12, 2022. The commonly accepted definition of a bull market is when stock prices rise by 20%.

For those of you who attended our annual client update last year, you may recall that Micheal Campbell, our guest speaker, scared us all with his dissertation on excess debt and a slowing economy. His comments were made on October 17, just as this “technical bull” was starting! This underscores our core investment advice: Always be appropriately invested and properly diversified.

Bull Market?

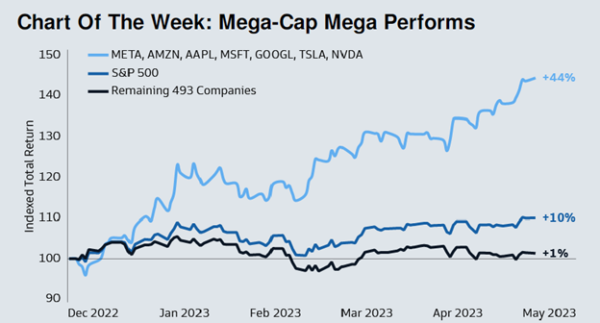

So, does this 20% gain in US stocks mean we really are in a true bull market? Perhaps, but there may be a warning here. In the last 50 years, no bull market has started with rates still rising4. Also, this bull has been very narrow, meaning that much of the gain in the S&P500 index was derived from a handful of companies. Lisa Shalett, Chief Investment Officer at Morgan Stanley Wealth Management, made this warning:

“Exuberance around artificial intelligence, along with a resurgent US dollar, has produced extreme divergence and concentration risk in the main stock indexes. Such narrowness is not what new bull markets are built on.”

Seven mega-cap tech companies, Apple, Microsoft, Amazon, Alphabet, Nvidia, Tesla, and Meta account for a large share of the gains. Goldman Sacks put out a piece on May 26 (see below) that showed that these seven tech stocks had a combined return year-to-date of 44% but the remaining 493 companies were up just 1%6!

It should be noted that these tech companies helped the S&P500 do rather badly in 2022; it was down 12.2%7. In contrast, the Canadian index, the S&P TSX, was only down 5.8% in 2022 but is only up 4% to the end of June in 20238.

Really Big Tech

Here is an interesting fact if you don’t follow these things: On June 30 Apple became the first company in the world to be valued at $3 trillion. (It hit that level in 2022 but failed to close above it.) $3 trillion is 3,000,000,000,000. To put this in some perspective, $3 trillion in 100-dollar bills stacked would be 1,893 miles high9. The 2022 GDP of Canada is $2.14 trillion10. It might be my age, but it doesn’t seem that long, in 1997, that Steven Jobs, after he was fired in 1985, returned to Apple to try to revise its fortunes as it was on the verge of bankruptcy! Apple’s YTD move in 2023: +49.23%11.

Inflation is the Enemy

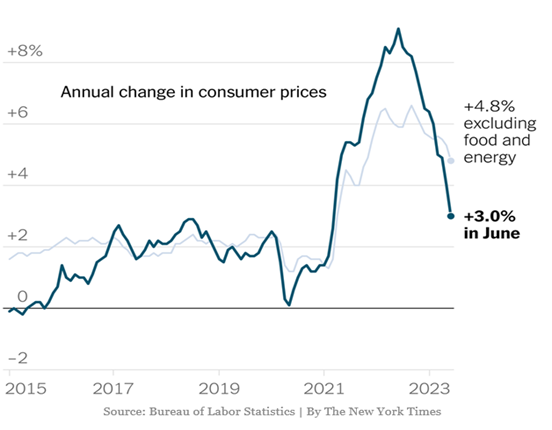

As we look forward, the key issue to track is Inflation. For markets, inflation is really everything as the central banks will not cease until they have tamed it and “not-ceasing” means higher interest rates, and higher interest rates generally mean slowing growth or a recession.

In Canada, there is some good news with the annual inflation rate in June down to 2.8%. It was 3.4% in May and 8.1% a year ago. It is now within the Bank of Canada target inflation range of 1 to 3%.

On July 12, Tiff Macklem raised the Bank of Canada benchmark rate to 5%, 475 basis points above where it was in early 2022 when it was only 0.25%. The prime rate is now 7.2%, a fairly big number that affects a large part of the market. Remember Canadians have a high proportion of variable debt compared to the US where most mortgages are 30-year fixed rate loans. Canadians are much more rate sensitive.

Tom and I were at the Vancouver CFA Dinner earlier this year and keynote speaker Mark Carney, Brookfield exec and former Governor of both the Bank of Canada and the Bank of England, said that the central banks will not be cutting interest rates this year. So far, he is right. However, the recent July move could be the last.

US Inflation Numbers

US inflation is also trending lower with June inflation just reported at 0.2% (0.3% was expected) and 3.0% over 12 months (3.1% was expected)12. Remember it was 9.1% in June 2022.

On July 7, data was released that showed the US economy added 209,000 jobs in June, lower than the consensus estimate of 240,00013. However, the job market remains strong, and the unemployment rate is 3.6%, which is basically full employment. Part of the problem is a historic shortage of workers and lagging labour force participation.

Powell’s goal is of course to keep inflation from being entrenched. The expectation is that inflation will continue to drop as it has over the past year. In June the Federal Reserve kept the federal funds interest rate in the range of 5% to 5.25%, but added 0.25% on July 26, perhaps the last move as well.

Recession or not?

So, the question remains: Is a recession coming? Several factors indicate we are heading for a recession:

- Yield curve – it is inverted which often indicates recession.

- Purchasing Managers Index (PMI) – it came in lower in June (PMI drops in recessions).

- Positive inflation – Yes, but it is getting better.

- Housing starts – I think this would be rated neutral.

- Labour market weakening – Not yet happening, but this is one to watch.

- Financial conditions – Yes, high rates mean conditions are tight.

- Leading indicators – Mixed but indicating a slowing economy.

The yield curve is often considered the big one. Inverted curves have preceded every recession for the past 75 years14. On average, an inversion has arrived 11 to 14 months before an economic contraction15. Both the 10-year/3-month and the 10-year/2-year differentials are inverted. This points to a recession.

Notwithstanding that the above indicators are showing stress, Goldman Sacks only two weeks ago revised its chance of a recession in the next 12 months to 25% from 35%16. On the other hand, Treasury Secretary Janet Yellen who just returned from a visit to China, said that “it is still too early to rule out the risk of a recession”, and Philip Petursson of IG Wealth on BNN Bloomberg put the chance of a recession in North America at 80%17! On the other hand (again!), the Chief Global Strategist at Nikko Asset Management, John Vail, put it this way:

- Economists have often predicted recessions that did not happen, so it’s not a huge surprise. In the first half, US consumers, especially wealthier ones who actually benefit from higher interest rates, have kept up their spending, partly due to accumulated savings and pandemic stimulus packages. Also, house prices did not fall much and thus there was not much of a negative wealth effect from that. Finally, the decline in gasoline prices helped confidence, there is much pent-up demand for automobiles after previous production shortfalls, and strong demand for travel and entertainment too18.

If you review all the midyear reports and analysis you will find well-reasoned arguments as to why we are now in a bull market and a recession is not coming, and equally well-resonated arguments as to why this is not a bull market but just an uptick – albeit a big one – in a bear market and a recession is just around the corner.

So what do we do?

Our strategy

We do what we have always done; we determine the risk tolerance of our clients and then build a well-diversified portfolio that provides growth opportunities with equity weights as well as defensive strategies such as bonds and alternative funds and a reasonable weight to real estate. Remember bonds go up in value when rates drop and, if we enter a recession, rates should begin to ease and bonds will do well. Alternatives funds neutralize market risk using strategies such as short selling. Real estate and private equity tend not to directly follow the equity markets so also provide some protection.

In our view, 2023 will be volatile (as we always seem to say) but of course we are staying invested as we think, if there is a recession, it will be short and growth will follow quickly.

UPDATE ON THE CHANGES TO ZLC WEALTH

We are halfway through 2023 and we hope you are benefitting from some of the technical changes we have introduced recently to improve our delivery of investment management services to you, our clients:

- Quarterback software helps us prepare your statements. It also gives us the flexibility us to make changes as we see ways to improve.

- Piersight is our new Client online portal that lets you access to your holdings, statements, and President’s Letter, all online at any time. This permission-based electronic service provides you with everything you need safely and securely. If you haven’t signed on yet, email us at wealthinfo@zlc.net and we will help you get to “no more paper”.

- Mako electronic forms allow for the easy integration of various forms and your signature done electronically.

- Evolution software helps us manage your “Fee-Based” accounts allowing us to separate our management fees from the cost of each investment. Benefits to you are:

- Transparency – our fees are clear and disclosed on your statements.

- Establishes an advice-based relationship that supports our fiduciary responsibilities.

- Lower costs for you by using passive investments (exchange traded funds or ETF’s) where active management struggles to outperform.

- More efficient portfolio monitoring and rebalancing.

- As your account grows, our cascading fee schedule provides lower marginal cost to you.

- Fully deductible fees for taxable accounts.

Our goal is to keep your costs the same or lower while providing the outstanding portfolio management you have come to expect from our firm. Please let us know if you have questions or comments.

The ZLC Wealth Service Team

- Garry Zlotnik FCPA, FCA, CFP, CLU, ChFC, Chief Executive Officer & Portfolio Manager

- Jon McKinney CPA, CA, CIM®, President & Portfolio Manager

- Tom Suggitt CFA, CIPM, CFP, FCSI, Vice President, Portfolio Manager & Head of Investment Oversight

- Grace Domingo, Vice President of Administration

- Lisa Der, Senor Account Manager

- Mark van Koll CPA, CGA, FCSI, CAMS, Chief Compliance Officer

We’re here to help in any way we can.

Kind regards,

The ZLC Wealth Team

Sources:

1 CBC News, March 22, 2023 https://www.cbc.ca/news/canada/canada-record-population-growth-migration-1.6787428

2 CBC News June 28, 2023 https://www.cbc.ca/news/politics/canada-record-immigration-1.6891590

3 Fraser Institute, Josef Filipowicz and Steve LaFleur, 2023

4 https://betterdwelling.com/canadas-gap-between-real-estate-prices-and-incomes-looks-ridiculous-beside-us-data/

5 Royal Bank of Canada, June 27, Robert Hogue and Rachel Battaglia, https://thoughtleadership.rbc.com/proof-point-soaring-construction-costs-will-hamper-canadas-homebuilding-ambitions/

6 Goldman Sachs Asset Management, Market Monitor, Week ending May 26, 2023.

7 https://ycharts.com/indices/%5ESPXTRCAD

8 S&P/TSX Composite Fact Sheet, June 30, 2023, https://www.spglobal.com/spdji/en/indices/equity/sp-tsx-composite-index/#overview

9 3 trillion: https://www.thecalculatorsite.com/articles/finance/how-much-is-a-trillion.php

10 https://tradingeconomics.com/canada/gdp

11 Apple: Yahoo Finance, year-to-date to June 30, 2023

12 US Inflation: https://tradingeconomics.com/united-states/inflation-cpi

13 US jobs data: https://www.bls.gov/

14 Inverted yield curve: https://finance.yahoo.com/news/treasury-yield-curve-just-inverted-sounding-alarm-recession-194921816.html

15 Inverted yield curve: https://www.rbcwealthmanagement.com/en-eu/insights/yield-curve-inversion-a-wake-up-call-for-investors

16 Goldman Sachs: https://www.goldmansachs.com/intelligence/pages/why-a-us-recession-has-become-less-likely.html

17 Philip Petursson: https://www.bnnbloomberg.ca/video

18 Bloomberg, John Authers, Opinion, Points of Return July 13, 2023: 2-4-6-8! It Is Time to Disinflate!

DISCLAIMER: This newsletter is solely the work of the author and for the purpose of providing information only. Although the author is a registered as a Portfolio Manager at ZLC Wealth Inc. (“ZLCWI”), this is not an official publication of ZLCWI. The views, including any recommendations, expressed in this newsletter are those of the author alone, and are not necessarily those of ZLCWI. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. This newsletter is not, and under no circumstances is to be construed, as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. Any rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the investment or potential returns on an investment. Commissions, trailing commissions, management fees and expenses may be associated with investments. Please read the offering memorandum or prospectus of any Fund before investing. Any indicated rates of return are based on the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc (“ZLCWI”). Returns are net of fees and include reinvested dividends. The performance of any fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLCWI. Please speak to a ZLCWI Portfolio Manager or Representative to determine if these products are right for you.