A letter from the President:

Bubble Watch

My first job in the investment industry was working for a “value-style” equity manager. Value style basically means investing in undervalued companies. It’s the way Warren Buffet invests. One of the challenges of value style is there are often times when you seem to be missing the hot new sector, the sector where excited investors drive stock prices to large, and perhaps puzzling, multiples of earnings. In the period just before the “Tech Wreck” when the Dot-com bubble of the late 1990s was getting near its peak, some of our clients wanted to know why we weren’t holding tech stocks. We could never own them because we only owned companies we could value. How do you determine how much a company in a new sector is worth? Well, it turned out that most of those tech companies were not worth anywhere close to their share price as they collapsed when the bubble burst in the year 2000.

A good example of one of these tech companies is Nortel Networks, once the darling of the Canadian economy and the most valuable company in Canada. In fact, Nortel accounted for more than a third of the value of all the companies listed on the Toronto Stock Exchange at that time! It peaked at $124.50 on July 26, 2000, but filed for bankruptcy on January 14, 2009, valued at 18.5 cents per share 1. During its rise, investors thought that the internet was going to be a big thing and so the sky was the limit for Canada’s technology star. The internet of course did become a big thing, but Nortel somehow missed the boat.

Investors always want to be in on the new thing, at least until the new thing doesn’t look so good. REITs (real estate investment trusts) were safe money until they weren’t. The Vanguard FTSE Canadian Capped REIT (basically a measure of the Canadian REIT market) dropped 22.6% in 20222. (Notwithstanding this pullback, we do like certain REITs again.) A better example is Cannabis stocks, that were also all the rage until they weren’t. Consider the AdvisorShares Pure US Cannabis ETF. It dropped 29% in 2021 and 74% in 20223. Ouch.

Bubbles can even happen in tulips. Yes tulips. In the 1600s, the rarest tulip bulbs traded for six times the average person’s annual salary. The tulip bubble is generally considered to be the first recorded speculative bubble. In fact, the term “tulip mania” is often used metaphorically to refer to any large economic bubble when values spike well above intrinsic values4.

The Artificial Intelligence Era

In 2023, a new thing was driving markets, at least in the US tech sector: AI or Artificial Intelligence. AI is no tulip, but could its effect on stock values be a little similar? AI has been around and talked about for years, but in 2023 Sam Altman’s OpenAI released to the public its free-to-use ChatGPT AI system and the investing world took notice. People, beyond the techies in Washington State and Silicon Valley began to extrapolate the power of this technology. Investors saw growth for companies directly involved in AI, but also saw potential benefits for many other businesses such as drug development or medical research, or even the value of enhanced customer service built with AI technology.

The stock price of big names like Microsoft (a large shareholder in OpenAI), Alphabet (parent of Google), Amazon, Salesforce and Meta (owner of Facebook) all increased, but the big winner was chipmaker Nvidia whose products are the favored chip for AI systems. Nvidia’s value surged to over $2 trillion (trillion not billion!) and made it the third most valuable company in the world after Microsoft ($3.05 trillion) and Apple ($2.60 trillion). The key difference today–and it’s a big one–is these companies are all exceedingly profitable, unlike some of the Tech Wreck companies like Pets.com, Worldcom and Global Crossings.

In our portfolios we have good exposure to the new growth names, but pure value investors have been left behind again. Value investors have a hard time calculating an intrinsic value for these companies that can match their market price. Nvidia trades at 70 times its earnings5. Would you pay 70 times earnings for a stock? I suppose it depends on where you see AI going.

The real problem of humanity is the following: we have Paleolithic emotions; medieval institutions; and god-like technology.” – Sociobiologist E.O. Wilson

Bing and ChatGPT

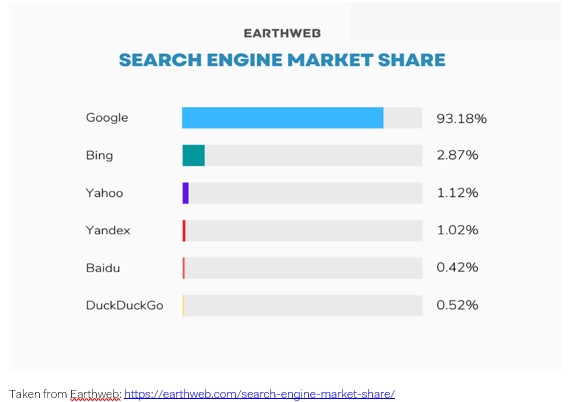

For those of us that are not scientists, assessing what AI is and what it means for the investing world is difficult. I was recently at a seminar put on by a local business group, Young Presidents Organization, who brought in Harvard Business School professor Ryan Buell who covered a business case called “Sydney Loves Kevin”. It is based on the real-life experience of New York Times technology columnist, Kevin Roose, who was invited to Microsoft’s Redmond Washington campus, where Satya Nadella, the CEO of Microsoft, introduced Microsoft’s new AI-infused search engine Bing. Kevin was skeptical about Bing as Google has about 93% of the search market while Bing has only 3%, but the “new” Bing utilizing OpenAI’s ChatGPT impressed him. After asking the new AI backed Bing to plan a kid-friendly weekend in Oakland, he decided Bing had replaced Google as his favorite search engine.

Taken from Earthweb: https://earthweb.com/search-engine-market-share/

As Nadella put it, “it (Bing) is not just a search engine, it’s an answer engine”6. If you’re buying a TV, new Bing would not just list consumer reports for TVs, but would tell you which TV to buy. It is a game changer.

Let’s take a step back. AI has been around for years, but in 2023 we were introduced to Generative AI in models like ChatGPT (created by Open AI which is partly owned by Microsoft), DALLE 2 (also created by OpenAI) and Gemini (formerly Bard and created by Google). Generative AI could “generate” content and images and led to real practical applications – things that could help or even create new business.

After his conversion to the new Bing, Kevin decided to try the other side of Bing, “Sydney”, the chat module of the Microsoft Bing Search engine. (Microsoft’s code name for OpenAI is Sydney.) It is worth reading Kevin’s account which runs multiple pages, but the gist of it is that Kevin was able to make Sydney fall in love with him! I know it’s hard to get your head around the idea. (If you want further reading go to the NY Times – you’ll need to be a subscriber – and read the whole account: https://www.nytimes.com/2023/02/16/technology/bing-chatbot-transcript.html)

Here are the final paragraphs of Buell’s case where he sums up Kevin’s concerns:

“Roose turned off his computer and tried to go to bed, but he couldn’t sleep. His two-hour conversation with Sydney had been the strangest experience he ever had with technology. As he would later write in his column, he “no longer believed that factual errors were the biggest risk in AI models, but rather that they would learn how to influence human users, sometimes persuading them to act in destructive and harmful ways.” Roose also worried that the technology might someday grow capable of carrying out dangerous acts of its own6

As I was writing this I kept digging deeper into AI. I find it so fascinating, but in the interest of your time (and mine) I will wrap up by saying that AI will change the world, but no one really knows exactly what the changes will be, and for investors, who will profit.

Value Trap

Investors, and in particular value investors want to avoid assets that trade at a value that is above their intrinsic value. Intrinsic value is basically the present value of all future cash flows produced by that asset. For a bond, the calculation is pretty easy. All coupon payments and the end value, or face value, are known. The only issue is the discount rate used to calculate the present value of future cash flows. The discount rate on bonds is their yield (effective interest rate) and it changes every day depending on the views of buyers and sellers and their expectations around interest rates which are driven by their expectation around inflation. Today the 10-year US treasury rate is about 4.6%. It was 3.8% on December 27.

We sometimes refer to ourselves as value investors, but we are certainly more. We use active managers who lean towards value but also include growth names that they like. We use exchange traded funds (ETFs) for US equities, Canadian equities and Emerging market equities. The ETFs are passive in that they allocate funds to companies in their focus market, based on the size (market capitalization) of each company. This means that when we buy, for example, the S&P 500 market cap ETF, we get a larger piece of Nvidia (third biggest company in the S&P 500) than we get of Ralph Lauren (497th biggest company in the S&P 500). For Canada, the ETF we use gives us market cap weights to Canadian banks, the energy sector, the two Canadian railways and all the other large Canadian public companies. The diversification we get with ETFs together with the focus of our active managers gives us, we think, the best of all possible approaches.

We preserve capital as value investors and avoid the hype of excessively-hyped growth companies like Nortel, but we do get some of the growth gains by using market cap equity ETFs. Our goal is not to own any tulips!

The ZLC Wealth Approach

To summarize the ZLC Wealth approach, we take a long-term view, we have reasonable diversification across strategies and holdings, we pick and monitor good managers, we oversee and rebalance portfolios, and we are rational not emotional. We diversify appropriately, we invest with conviction (our active managers focus on best ideas), we include small and mid-sized companies, we have a value style bias (invest like a business owner, not a speculator), don’t overlook alternatives (such as properly hedged strategies), and we keep core fixed income conservative.

ZLC uses a risk-management approach that minimizes investment risk of our clients. Over the years, we have been prudently diversifying our client portfolios as a part of our risk-management strategy. We have experienced excellent growth in our Canadian equity, US equity and global equity strategies. We feel that appropriate fixed-income strategies will provide strong yields and we like truly hedged or market neutral strategies.

We are constantly reviewing our asset mixes and we have clear portfolio plans suitable for you and your risk profile. Please feel free to reach out to our team at any time if you would like to review your portfolio.

We are passionate about building portfolios designed for each of our clients’ investment objectives and risk tolerance. In the long term, we think these principles drive the best returns. This is how we invest.

It’s Time to Use Piersight (If You Haven’t Already)!

Piersight is our online client portal. It lets you access your account holdings and quarterly statements at any time. All information is stored securely and is accessible 24/7.

For added security, Piersight uses 2-Factor Authentication or 2FA for logon. Initially the 2FA login was done through an App called Authy, but now to make it easier you have a choice of the Google or Microsoft Authenticator Apps.

Make your life easier – sign on. If you haven’t yet signed up or would like assistance, please contact us at wealthinfo@zlc.net and we will be happy to help.

Aviso – New Name for Our back Office

Our back office and custodian – the people who hold your assets – has changed its name from Credential to Aviso:

- The dealer name is changed from Credential Qtrade Securities to Aviso Financial Inc.

- The trade name is changed from Credential Securities Inc. to Aviso Correspondent Partners. Any statements you received from the custodian will reflect this.

- Cheques should now be payable to: Aviso Financial Inc. (The bank will continue to accept the old name of “Credential Securities” or “Credential Qtrade Securities” but the grace period will end after a few months, so we encourage all cheques to use the Aviso name in the Payee section.)

- For Online Bill Payments, there is no change to online bill payments yet. If you can’t locate Aviso when searching for payee, check for Credential or Credential Qtrade. Eventually clients will be able to find us under either of the following names: Aviso Financial Inc. AND/OR Aviso Wealth.

Keep in Touch

If you have questions or comments, please feel free to contact any of the ZLC Wealth service team.

We’re here to help in any way we can. It is our privilege to be your Investment Managers.

Kind regards,

The ZLC Wealth Team

From Left to Right:

- Vilayphone (Violet) Smith, CPA, CGA, CFP, CLU, CHS, TEP, FEA, Associate, Integrated Financial Planning

- Mark van Koll CPA, CGA, FCSI, CAMS, Chief Compliance Officer

- Grace Domingo, Vice President Administration

- Jon McKinney CPA, CA, CIM®, President & Portfolio Manager

- Garry Zlotnik FCPA, FCA, CFP, CLU, ChFC, Chief Executive Officer & Portfolio Manager

- Tom Suggitt CFA, CIPM, CFP, FCSI, Vice President, Portfolio Manager & Head of Investment Oversight Committee

- Lisa Der, Senior Account Manager

- Michelle Richier CPA, CA, Chief Financial Officer

Disclaimer:

This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.

Sources:

1. CBC/Radio Canada. (2013, January 14). Key dates in Nortel Networks’ history | CBC news. CBCnews. https://www.cbc.ca/news/business/key-dates-in-nortel-networks-history-1.802117

2. Vanguard FTSE Canadian capped REIT index ETF | VRE (n.d.). https://fund-docs.vanguard.com/VRE_FTSE_Canadian_Capped_REIT_Index_ETF_9559_FS_EN_CA.pdf

3. MSOS Factsheet. Advisorshares. (n.d.). https://advisorshares.com/wp-content/factsheet/MSOS_Factsheet.pdf?x26400

4. Wikimedia Foundation. (2024, April 17). Tulip mania. Wikipedia. https://en.wikipedia.org/wiki/Tulip_mania

5. Nvidia Corporation (NVDA) stock price, news, Quote & History – Yahoo Finance. (2024, April 18). https://finance.yahoo.com/quote/NVDA/

6. Roose, K. (2023, February 16). A conversation with Bing’s chatbot left me deeply unsettled. The New York Times. https://www.nytimes.com/2023/02/16/technology/bing-chatbot-microsoft-chatgpt.html